For many people, long term care can be a gray area in retirement planning.

There are several questions that people often don’t have clear answers to: How likely is it that I will need long term care? Is long term care insurance a good idea? What are the financial risks of long term care? Is any of it covered by Medicare?

The truth is that long term care poses a significant financial risk for people approaching retirement age, and it’s important to have a plan to help cover these expenses, whether through self-insuring or purchasing an insurance policy.

According to the U.S. Health and Human Services Department, people turning 65 years old have a 70% chance of needing long term care services at some point as they age. These services can be provided by a home health care agency, an assisted living facility, or a nursing home.

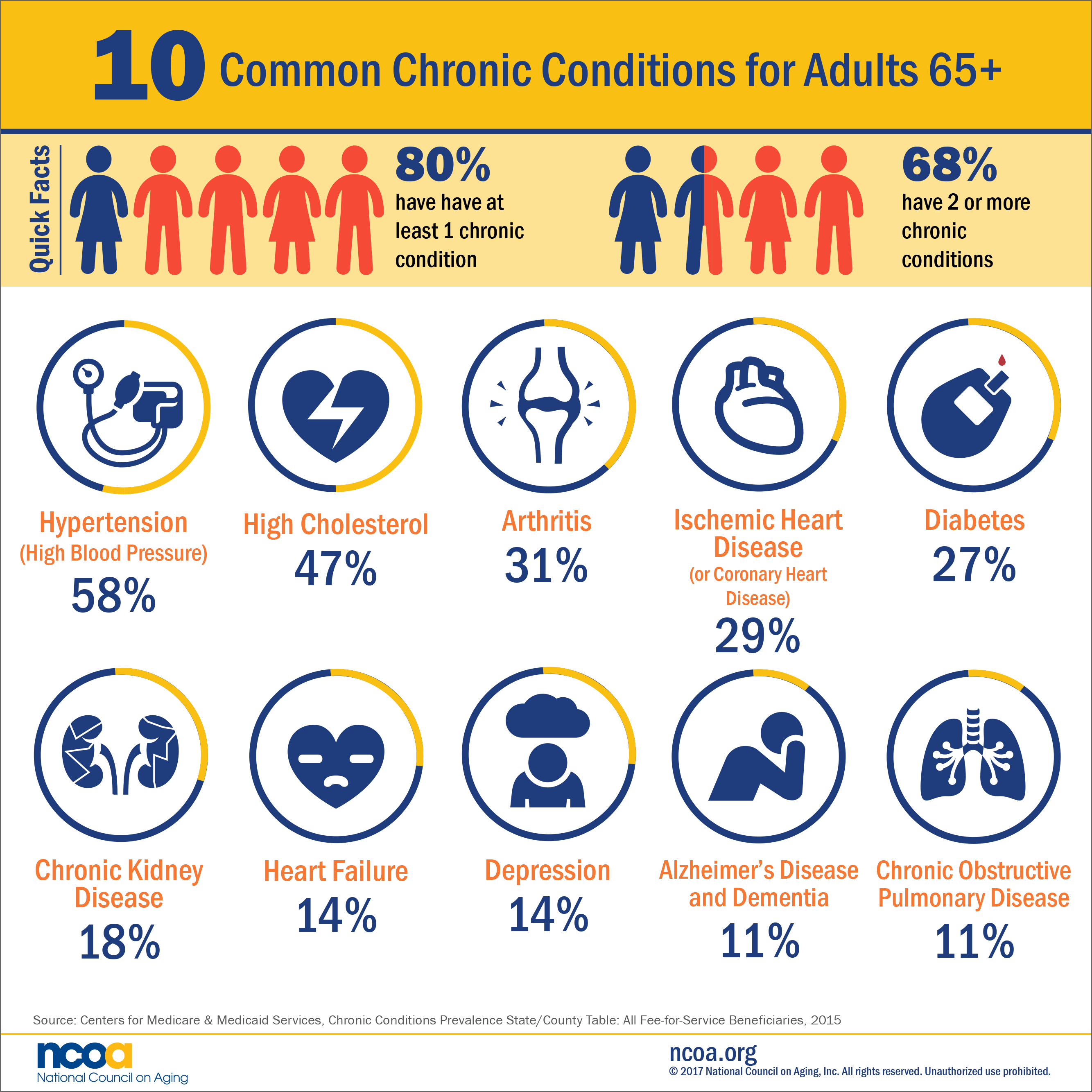

In addition, 80% of adults 65+ have at least one chronic condition, and 68% have two or more. Common chronic conditions – in combination with other factors – often create situations where it is necessary to employ long term care services to help maintain health and perform day-to-day tasks safely.

Many people don’t plan for long term care expenses because they assume that Medicare will cover long term care. Unfortunately, this is a very common misconception that can create disastrous financial consequences for people who do not have a plan in place to help manage these expenses.

While Medicare can cover some health care expenses such as skilled nursing care, therapy, and personal care in the event of a temporary illness or injury, Medicare does not cover long term care.

It’s important to realize how vulnerable you may be if you don’t have a plan to cover long term care expenses later in life.

For example, as of 2020, the median cost of a private room in a nursing home in Orlando, Florida is $9,703/month. The median cost of an assisted living facility is $3,700/month, and home health care is $3,813/month. These numbers are even higher in other parts of the country.

When you consider the possibility that you may be paying for these services for multiple years, it’s not difficult to imagine how drastically such expenses can deplete a savings account or other critical asset.

Here are some common outcomes that affect many people who do not plan for long term care expenses:

You may have to liquidate assets to pay for care

Since Medicare does not cover long term care, a chronic illness may give you no choice but to pay for care with assets you have worked hard to accumulate such as your house, savings, and investments.

Your family may have to pay for your care

This is a common situation for families across America. If there is no financial plan in place to help with long term care expenses, family members may struggle to find the money to pay for high-quality care.

One of the most commonly cited reasons why people are interested in planning for long term care is so that the burden of paying for it will not fall on their children.

Family members are often part-time caregivers as well, and it can be challenging to manage the logistical difficulties of being a caregiver along with the financial difficulties paying for long term care.

You may have limited options to choose from if you need care

If you haven’t self-insured or bought an insurance policy, you may have to rely on Medicaid to pay for long term care. However, Medicaid should be seen as a last resort for several reasons:

1 ) Medicaid requires you to spend down virtually all of your assets before it will pay for care, and there is a 5 year look-back period on your finances. If you plan to use Medicaid to pay for long term care, your assets are not protected.

2 ) If you rely on Medicaid to pay for long term care, you will only be able to receive care at institutions approved by Medicaid. These are usually the least expensive facilities and may be of lower quality. You also won’t have the flexibility to receive care at home from a home health care agency of your choice.

You may not need long term care

Of course, it’s possible that you won’t need long term care and you won’t have to pay for these kinds of services. But when you consider how common the need for long term care is (70% of people turning 65 will need it later in life) and the drastic financial risks associated with long term care expenses, it’s a bad idea to hope or assume that you will not need it.

How to plan for long term care

Having a plan to cover these expenses helps to ensure that your health and financial future are secure. For certain people, it is possible to self-insure for LTC risk. For others, it is more effective to purchase an insurance policy.

But what kind of policy should you consider?

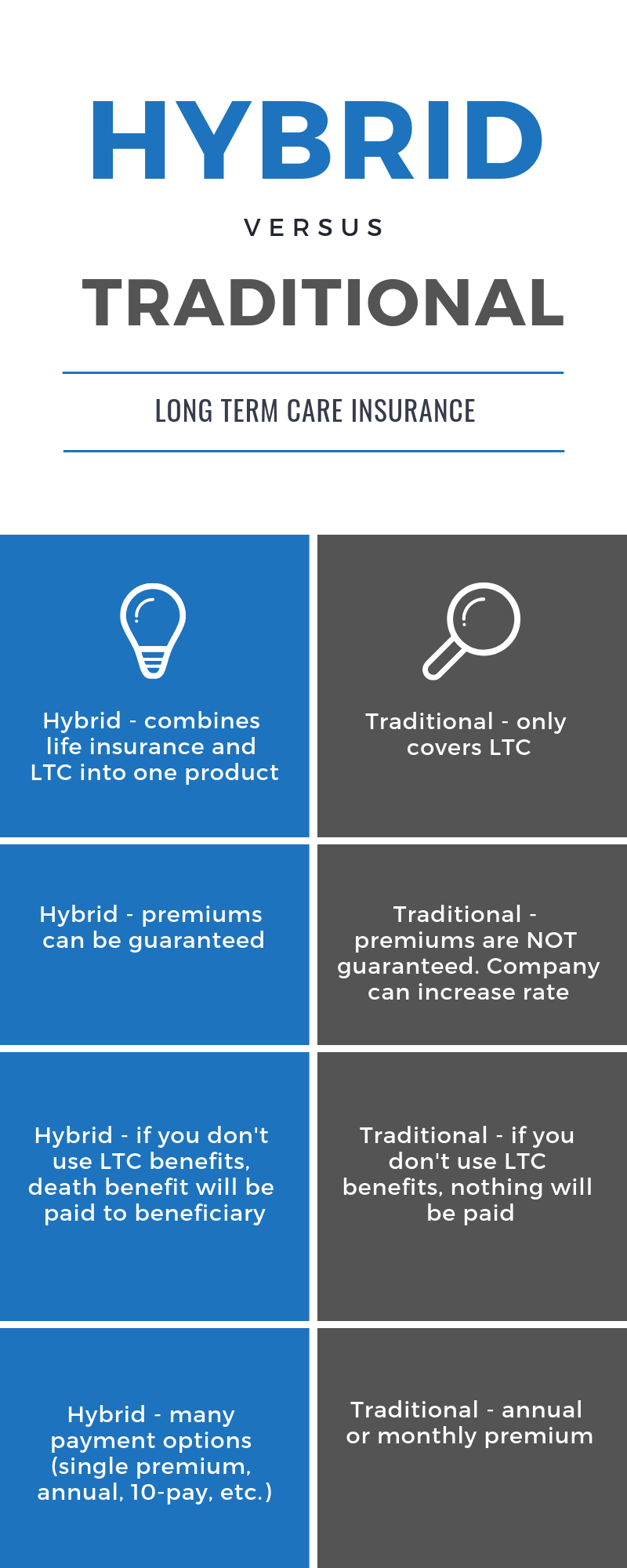

Long term care insurance is designed to cover this risk and, on the surface, seems like a good idea. However, the traditional LTC insurance model has faced extreme financial difficulties in recent years due to miscalculations and bad pricing decisions made by companies when issuing policies decades ago.

As a result, many owners of traditional LTC insurance plans have faced premium increases that have forced them to drop their coverage or reduce their benefits. On traditional LTC insurance plans, companies can increase premiums whenever they can get state approval to do so.

For example, Genworth – one of the leaders in the long term care insurance industry – has lost $2 billion in the last five years on these policies, and the company has stated that they intend to ask Massachusetts state regulators to approve an astonishing 275% premium increase over the next 3-6 years. Other companies like John Hancock have dropped out of the traditional LTC insurance market altogether due to similar difficulties.

These financial woes have been widely publicized, and Americans looking to cover LTC risk are left in a bind. They know they need coverage and they want to make a responsible decision, but they are rightfully skeptical of an insurance industry that is so volatile and ill-prepared to meet their needs.

An attractive alternative to the traditional LTC insurance model is hybrid life/LTC insurance. Hybrid policies combine life insurance and LTC insurance into one product and have two critical features that set them apart from traditional LTC plans: a premium guarantee and a death benefit.

Since hybrid policies are life insurance contracts, they are structured differently from traditional LTC plans, and the premiums can be guaranteed not to increase. And the existence of a death benefit means that if you never need the LTC benefits, your beneficiary will receive a full death benefit from the policy.

These two features offset the two major disadvantages of traditional LTC insurance: the drastic premium increases and the use-it-or-lose-it nature of LTC benefits.

Depending on your age and financial situation, a hybrid policy can be a great way to obtain reliable LTC coverage and secure your financial future.

At Hybrid Policy Advisor, we specialize in finding the best hybrid long term care insurance solutions for every client we serve. We compare quotes from all the major companies and provide side-by-side comparisons with traditional LTC insurance plans so that you can make an informed decision. Every person’s situation is different, and we believe in the importance of tailoring our recommendations to each person’s unique needs and circumstances.

If you would like to learn more, give us a call at 1-866-365-6558, or click the button below to fill out a quote request form. We look forward to hearing from you!

Sources