When putting together a financial plan for the future, it’s important to understand the most common chronic diseases you might face as you age.

Long term care for chronic illnesses can be expensive and is usually not covered by health insurance. Having a firm understanding of these diseases can help give you the confidence to make healthy choices and commit to a comprehensive plan that will cover potential long term care costs.

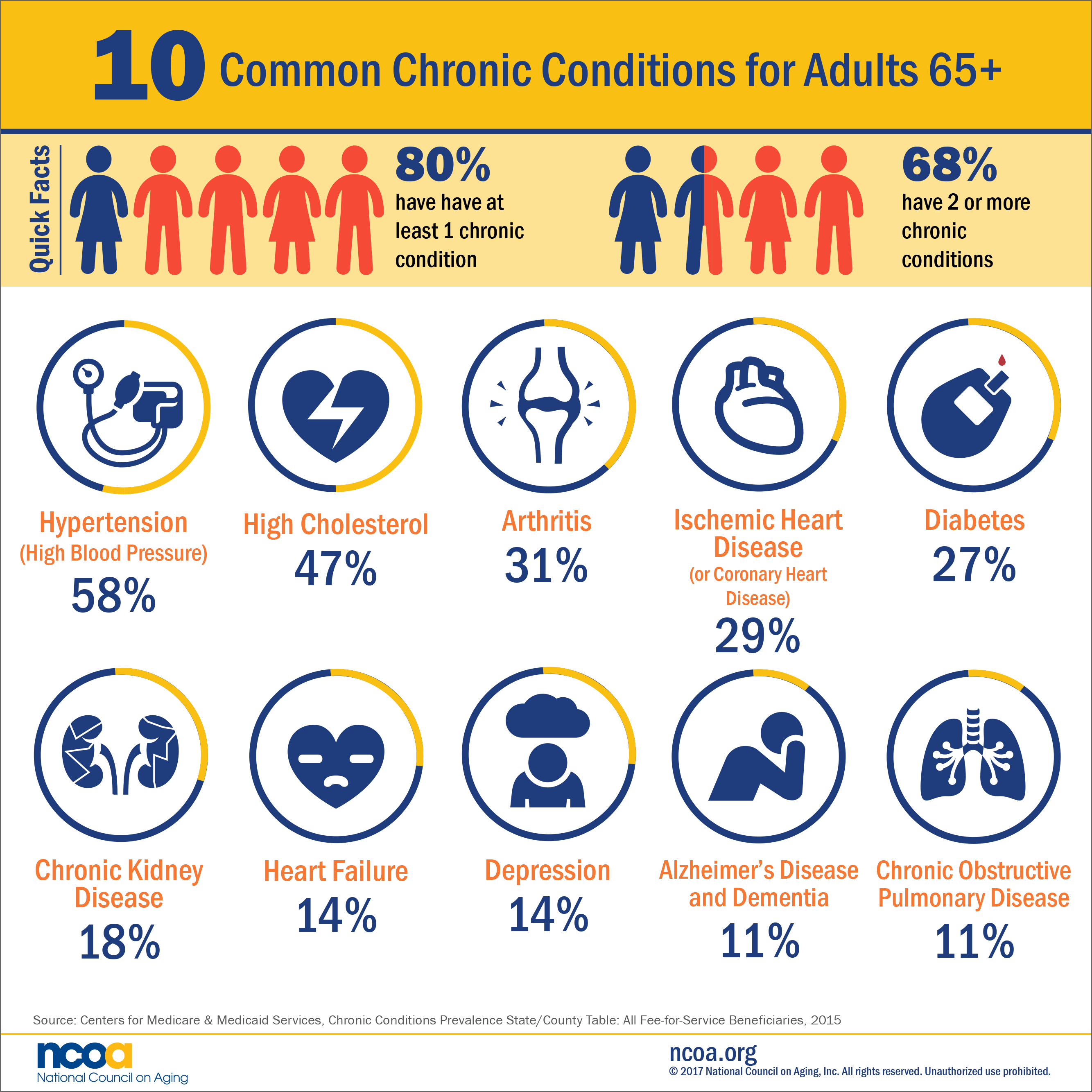

By the numbers

Here are some critical facts to consider:

- According to the National Council on Aging, 80% of adults age 65 and older have at least one chronic disease, and 68% have 2 or more chronic diseases.

- Chronic diseases account for 95% of healthcare costs in Americans 65 and older.

- Chronic diseases account for over 2/3 of all healthcare costs in the US.

Healthy living can go a long way in preventing these conditions, especially by avoiding behavioral risk factors. According to the CDC, these are the main risk factors for developing the most common chronic diseases:

- Tobacco use

- Poor nutrition

- Lack of physical activity

- Excessive alcohol use

However, healthy people also develop chronic conditions as they age. Conditions such as hypertension and high cholesterol are very common, and many people are unaware of the financial risks associated with chronic illnesses that can result from these underlying conditions.

If you develop a chronic condition that requires long term care from a home health care agency, nursing home or assisted living facility, you may have to pay these expenses yourself.

Medicare is not designed to cover long term care, and Medicaid will only cover long term care after you prove that you have spent down virtually all of your assets.

If you own a long term care insurance policy and develop a chronic illness, you will be able to receive benefits from the policy if a doctor verifies that your condition is severe enough that it prevents you from performing at least 2 of 6 Activities of Daily Living (ADLs). These include bathing, continence, toileting, transferring, dressing and eating.

However, long term care insurance premiums on traditional policies have skyrocketed in recent years. As a result, many policyholders have had to reduce their coverage or cancel their policies. New customers are justifiably reluctant to purchase traditional long term care insurance, even though they know they need coverage.

Hybrid long term care insurance has become an attractive alternative to the traditional LTC model.

By securing chronic illness benefits or long term care benefits on a life insurance policy, policyholders are able to receive a premium guarantee and a death benefit -- two key features that are not available on traditional LTC policies.

At Hybrid Policy Advisor, we provide quotes from all of the best companies offering hybrid long term care insurance products. As an independent agency, we are dedicated to finding the best possible long term care solutions for each and every client we serve.

If you would like to learn more, please give us a call at 1-866-365-6558, or click the button below to fill out a quote request form or send us a message. We look forward to hearing from you.