Hybrid policies, also known as 'linked benefit' or 'asset-based long term care' policies, have become increasingly popular as the traditional long term care insurance model continues to struggle.

A new LTC insurance model

These hybrid products, which function primarily as life insurance policies, are able to provide long term care benefits or chronic illness benefits in a more consumer-friendly way that avoids the major pitfalls of the traditional long term care insurance model.

For example, the premiums on a hybrid policy are guaranteed not to increase.

By contrast, traditional long term care insurance plans have seen massive premium spikes in recent years, which have forced existing policyholders to reduce their coverage or cancel their policies altogether.

In Florida, premiums on traditional LTC plans rose an average of 20.6% from 2010-2016, although many companies requested much higher increases from state regulators.

In 2018, Genworth, one of the leading companies in the traditional LTC industry, raised premiums by an average of 53% through the third quarter. Like many other companies, they eventually announced that they would suspend new sales of their traditional LTC products through brokerage general agencies.

In fact, 90% of insurers have pulled out of the traditional long term care insurance market.

It's incredibly important to have a plan for potential long term care costs later in life, and it's obvious that people still need coverage, so companies and consumers have been turning to hybrid policies as an attractive alternative to the traditional LTC insurance model.

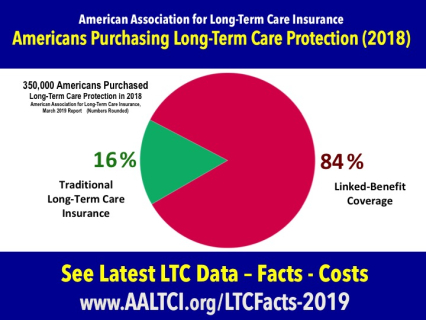

According to the American Association for Long Term Care Insurance, 350,000 Americans purchased long term care insurance protection in 2018.

84% of those purchases were 'linked-benefit' policies that combine life insurance with long term care benefits.

Consumers often express trepidation about traditional long term care insurance because the premium amounts are not guaranteed to remain stable throughout the life of the policy. (In fact, they are almost guaranteed to increase based on historical trends in the industry).

In addition, the traditional LTC model provides no benefits beyond long term care, so if you never need the benefits, you never receive anything from the policy.

Hybrid policies, by contrast, include a death benefit. So if you never need the LTC benefits, a full death benefit will be paid to your beneficiary.

At Hybrid Policy Advisor, we can provide quotes for both traditional and hybrid long term care insurance so you can see the differences for yourself and make an informed decision.

As an independent agency, our goal is to find the best possible long term care insurance solutions for all our clients.

Every hybrid product is different in the features they emphasize, and there is no 'one size fits all' approach to finding the best product, so it's important to work with an agent who can compare quotes and provide recommendations that are tailored to fit your specific circumstances.

If you would like to learn more or request a quote, please click the button below to send us a message, or give us a call at 1-866-365-6558.

Sources

American Association for Long Term Care