Genworth, a company that owns 18% of the market share of traditional long term care insurance, has recently announced that it will suspend sales of long term care insurance through brokerage general agencies.

They will still offer LTC insurance sales through association programs and other channels on a limited basis, but their announcement represents a clear effort to reduce the amount of traditional LTC policies being sold to the public. These policies have been plagued by design flaws that underestimated how long policyholders would be claiming LTC benefits and overestimated the amount Genworth could make by investing the policyholders’ premiums. The miscalculations have had dire consequences.

Skyrocketing long term care insurance costs

Genworth has lost over $2 billion on these policies and recently announced that last year they diverted $327 million before taxes to shore up their LTC insurance reserves, in addition to raising premiums an average of 53% through the third quarter.

They also suspended sales of their Income Assurance Immediate Need Annuity product, which has often been purchased by people who are already receiving long term care and therefore cannot qualify for a LTC insurance plan.

These suspensions will not affect the contracts of current policyholders, but they demonstrate the failure of the traditional long term care insurance model. Companies like John Hancock and many others have pulled out of the traditional LTC market in recent years.

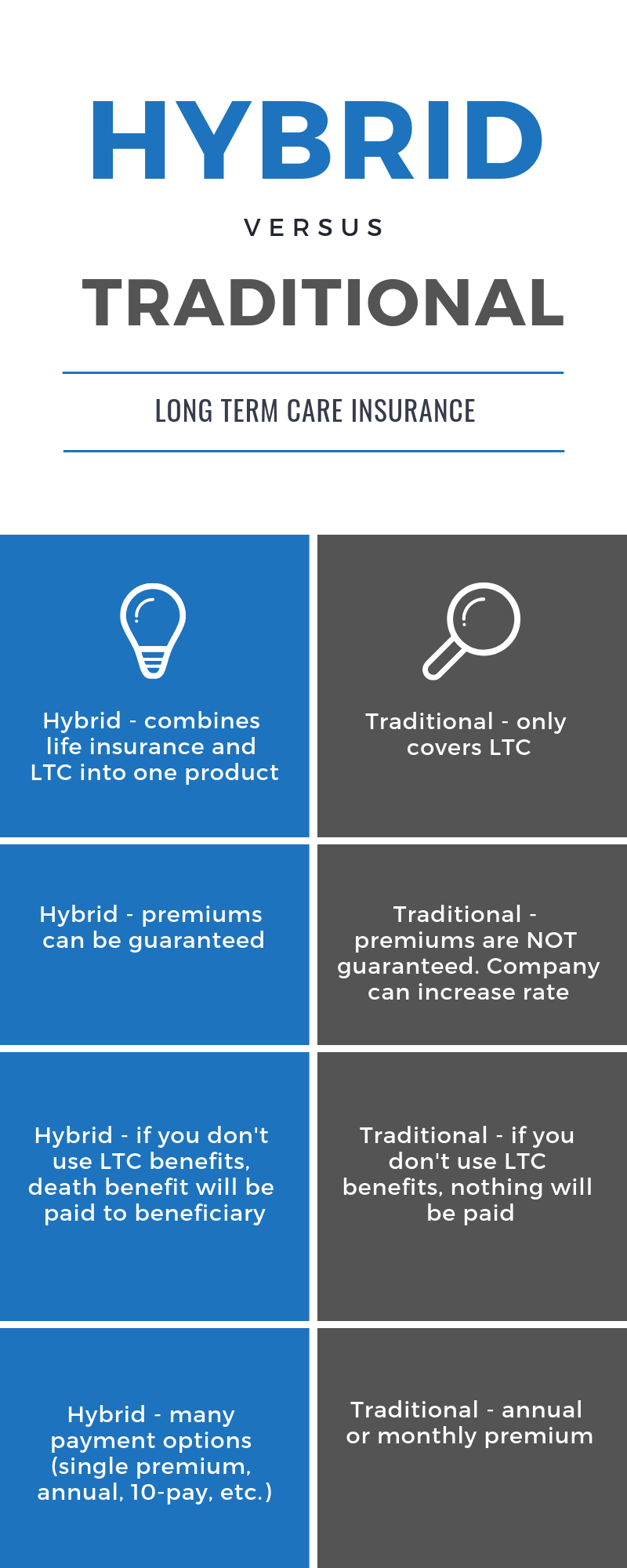

More and more customers and companies are turning their focus toward hybrid long term care insurance as a better way to provide LTC coverage. By purchasing life insurance with a long term care rider or chronic illness rider, policyholders can receive a premium guarantee and a death benefit.

These features make the hybrid long term care insurance model more consumer-friendly than the traditional long term care insurance model. Your premiums are guaranteed not to increase, and if you never need the LTC benefits, your beneficiary will receive a full death benefit.

If you would like to receive a quote for hybrid long term care insurance or request more information, click the button below to send us a message, or call 1-866-365-6558 to speak with an agent. As an independent agency, we strive to provide detailed comparative analysis of the different products available on the market to find solutions that are tailored to meet the needs of each individual client.

Sources